HOW TO FILING ONLINE ITR FOR AY 2018-19

The Central Board of Direct Taxes has notified the new ITR Forms for AY 2018-19 Income Tax Return Filing (for FY 2017-18). In order to make ITR filing easy, some sections of the forms have been rationalized.

The new ITR forms in PDF format have been made available, while the excel utilities (or) Java Utilities for AY 2018-19 will soon be made available on incometaxindia e-filing website.

What is Assessment Year (AY) & Financial Year (FY)?

Financial year (FY) is the year in which you have earned the income. If you are filing a return this year, the financial year will be 2017-18.

For example, if you have had an income between 1st April 2017 and 31 March 2018, then 2017-18 will be referred to as FY. Assessment Year (AY) is the year in which you file returns i.e., 2018-19. The last date to file returns for the financial year 2017-2018 is July 31st 2018 (as of now).

Income Tax Slab Rates for FY 2017-18

The income tax slabs & rates are categorized as below;

Individual resident aged below 60 years.

Senior Citizen (Individual resident who is of the age of 60 years or more but below the age of 80 years at any time during the previous year) &.

Super Senior Citizen (Individual resident who is of the age of 80 years or more at any time during the previous year).

AY 2018-19 Income Tax Return Filing | New ITR Forms

Below are the important details about new ITR forms;

The requirement of furnishing details of cash deposit made during a specified period as provided in ITR Form for the Assessment Year 2017-18 has been done away with from Assessment Year 2018-19.

NRIs can now provide details of their foreign bank accounts to claim credit or refunds. Earlier, they could only provide details of bank accounts held in India.

However, NRIs will no longer be able to file returns using the simple income tax return (ITR)-1 form, which can now only be used by residents. NRIs will have to use ITR-2, which seeks more information.

GSTIN number now has to be mentioned in ITR-4 filled by businesses and professionals claiming presumptive income. They also have to quote gross receipts as per GST returns.

The partners in firms will now have to file ITR-3 instead of ITR-2.

All the ITR Forms are to be filed electronically. However, where return is furnished in ITR Form-1 (Sahaj) or ITR-4 (Sugam), the following persons have an option to file return in paper form:-

An Individual of the age of 80 years or more at any time during the previous year (or)

An Individual or HUF whose income does not exceed five lakh rupees and who has not claimed any refund in the Return of Income.

FY 2017-18 Income Tax Return Filing | Which ITR form to file?

New ITR 1 (Sahaj) Form For Assessment Year 2018-19

The Central Board of Direct Taxes(CBDT) has notified Income Tax Return Forms (ITR Forms) for the Assessment Year 2018-19. For Assessment Year 2017-18, a one page simplified ITR Form-1 (Sahaj) was notified. This initiative benefited around 3 crore taxpayers, who have filed their return in this simplified Form. For Assessment Year 2018-19 also, a one page simplified ITR Form-1(Sahaj) has been notified.

This form can be used if you have;

Salary or Pension Income

Income from one house property (excluding cases where loss is brought forward from previous years)

No business income / no Capital gains

No asset in foreign country or no income from a source outside India

Agricultural income which is less than Rs 5,000

Income from other sources like FD/Shares/NSC etc.,

No income from lottery or horse racing.TR Form-1 (Sahaj) can be filed by an individual who is resident other than not ordinarily resident, having income upto Rs 50 lakh and who is receiving income from salary, one house property / other income (interest etc.).

Further, the parts relating to salary and house property have been rationalized and furnishing of basic details of salary (as available in Form 16) and income from house property have been mandated.

New ITR 2 Form for Assessment year 2018-19 :

ITR2 form can be filed by an Individual or Hindu Undivided Family (HUF). This form can be used if you have;

Salary or Pension Income

Income under the head ‘Capital Gains’

Income from multiple houses

No business / professional income under any proprietorship

An asset in foreign country or income from a source outside India

Agricultural income of more than Rs 5,000

Income from lottery or horse racing

If your income is more than Rs 50 Lakh, ITR 2 has a Schedule AL requiring assessees to declare their assets and liabilities at the end of the fiscal.

Click here to download new ITR 2 Form.

New ITR 3 for AY 2018-19 Income tax filing

Since AY 2017-18, the previous ITR 4 form has been re-numbered as ITR 3 form.

New ITR 3 form is for individuals and HUFs having income from a proprietary business or profession (or having income as a partner in a Partnership firm).

This ITR covers all kind of businesses and professions irrespective of any income limit. Assesse can also report his income from salary, multiple house properties, lottery winnings, capital gains, speculative income i.e. horse race in ITR3 together with the Business Income.

Click here to download new ITR 3 Form.

New ITR 4S (Sugam) form for AY 2018-19 / FY 2017-18

This form can be used by individuals who have;

Presumptive income from Business or Profession.

No Capital Gains

Agricultural Income which is less than Rs 5k

No asset in foreign country or no income from a source outside India

Income from one house property

Income from other sources

Click here to download new ITR 4S form.

Important points to consider before filing your ITR :

Before you file your Income Tax returns, check if your Form 26 AS has correct TDS entries. For example: Your employer might have deducted TDS amount for last quarter and deposited the amount on your behalf. Check for this transaction in Form 26 AS. Also, check whether all the investments with TDS have been duly mentioned in your Tax return form also. Any mismatch will lead to a notice from the department.

Do not file your ITR till you get Form-16 (issued by your employer, if salaried) and Form 16A. While Form 16 is for only salary income, Form 16A is applicable for TDS on Income Other than Salary. Form 16A is a statement containing all details of TDS Deducted on all Payments except Salary. For example, Form 16A is issued by banks when they deduct TDS on interest income earned on your Fixed Deposits / Recurring Deposits.

Form16, Form 16A and Form 26AS documents will come handy while filing your ITR. As discussed above, you have most of the details in your form 16 with which you can easily file your Tax Returns. Cross check your Form 16/16A TDS amounts with Form 26AS and then key in TDS details in ITR accordingly.

Based on Form 16, you can fill ‘Income’ and ‘TDS’ details. By looking at your Form 16 A, you can fill ‘income from other sources’ and ‘TDS’ details in ITR sheet.

Based on Form26 AS, you can cross check the above TDS payments and also fill in details of ‘Advance or self assessment tax’ payments (if any) in your ITR sheet. (Related Article : ‘Understanding your Form 16 & other Tax related forms – Form 16A & Form 26AS‘)

If you had joined a new company during the financial year then do not forget to declare the income from previous employer in the tax return.

You might have earned interest income on Bank fixed deposits, Bonds, National Saving Certificates (NSCs) etc., This income is taxable. (Interest earned on bank savings account is exempted upto Rs 10,000 but it should be included in filing). You have to declare all these incomes in your tax return.

In case, if your declared investment amount (to your employer) is more than your actual investments, you have to pay additional taxes while filing your Income Tax Return

In case, if your declared amount is less than your actual investments, your company might have deducted higher TDS. So, you can claim this as ‘refund‘ while filing your taxes. (Kindly read : ‘TDS & Misconceptions‘)

Even if you miss the deadline for submitting the investment proofs, you can still claim all the tax deductions (except few allowances like LTA or Medical allowance) while filing your Income Tax Return.

It is advisable to keep copies of all your original documents for your future reference.

Important Link :

official site Full Detail Pdf file

31st July is the last day to file your income tax returns this financial year, 2018-19. Nothing proves your financial wisdom and ethics like tax compliance – timely filing of ITR. Filing your income tax return is not as difficult as it may sound. Here is a step by step guide to e-file your income tax return using ClearTax. It is simple, easy and quick.

Step 1: ITR Efiling – Getting Started

Before we get started, you should have the following documents at hand to pace up the process:

PAN

Adhaar

Bank account details

Form 16

Investments details

Login to your ClearTax account.

Click on ‘Upload Form 16 PDF’ if you have your Form 16 in PDF format. If you do not have Form 16 in PDF format click on ‘Continue Here’

Step 2: Enter Your Personal Information

Enter your name, PAN, Date of birth and father’s name.

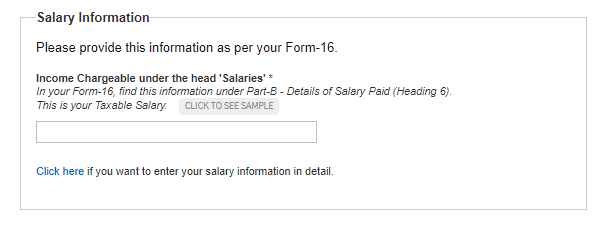

Step 3: Enter Your Salary Details

3a. Fill in your employer name and type.

3b. Provide your salary and TDS information. For entering the break up of your salary in detail ‘Click here’.

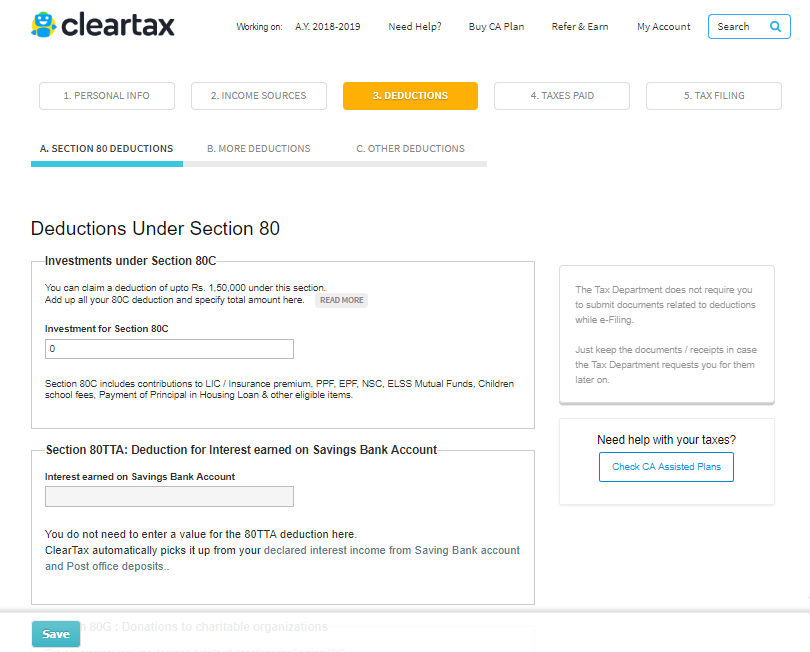

Step 4: Enter the Details for Claiming Deduction

Enter investment details for deductions to be claimed (eg. LIC, PPF etc., and claim other tax benefits here.

Step 5: Enter the Details of Taxes Paid

If you have any non-salary income, say, interest income or freelance income, then add tax payments that are already made. You can also add these details by uploading Form 26AS.

Step 6: e-File

Enter your bank account details and proceed towards e-filing.

If you see ‘Refund’ or ‘No Tax Due’ here, Click on proceed to e-Filing. You will get an acknowledgment number on the next screen.

Tip: See a ‘Tax Due’ message? Read this guide to know how to pay your tax dues.

Step 7: E-Verify

Once your return is filed e-Verify your income tax return.

Watch this video to know how to e-File ITR Online

Yay! You Are Done